Disaster relief is money paid out to those suffering as a result of natural (or man-made) disasters. 'Natural disasters' can mean lots of different things. To be clear, we're not talking about run-of-the-mill weather events like snowstorms or hurricanes, but catastrophes such as earthquakes and volcanic explosions.

Sometimes disaster relief is awarded by the state in question, or by a higher authority such as the United Nations. It can also be collected from private donors who are both located within or outside that area.

It's not just aid that victims receive either—disaster relief covers all sorts of things, including medicine and food for starving people.

In some cases, disaster relief may be requested by a country itself (i.e., when it's been hit by an earthquake). In other cases, nearby countries will donate supplies to those affected on their own initiative because they want to help out and they know it'll be appreciated—this sort of thing happens mostly among neighbouring nations with good relationships between them already

Is disaster relief taxable?

If you receive a disaster relief payment, it is considered income and must be reported on your tax return. If you receive these payments because of a loss from a federally declared disaster, you can deduct any casualty losses related to the disaster on your federal tax return. You can claim this deduction only if it’s more than any insurance reimbursement you received for the loss and if you itemize deductions.

How is disaster relief funded?

There are several ways that disaster relief can be funded, including by federal and state governments, through private donations, in-kind donations and corporate donations. International funding and loans may also be available to support relief efforts.

Federal funding for disaster relief primarily comes from the Federal Emergency Management Agency (FEMA), under the jurisdiction of the United States Department of Homeland Security. The Stafford Act mandates that FEMA is required to provide at least 75 percent of a state's costs for each program it finances; however, the state would pay 25 percent of such costs if it has sufficient funds. Other federal agencies can also provide funding after a disaster occurs. For example, the Small Business Administration offers low-interest loans to businesses impacted by disasters as well as non-profit organizations which provide services to them.

Who manages disaster relief accounts?

When you give to a disaster relief account, the money is managed by an individual organization. The organization will use the funds to provide whatever help is needed in the given situation—shelter, food, medicines, etc.—and these accounts are not part of the federal budget.

Where do donations go for disaster relief efforts?

As you're donating to a disaster relief effort or otherwise supporting their efforts, it's important to know that the funds are being allocated in a variety of places. You may think that all the money is going toward providing food, water, and shelter for those affected by a natural disaster—but it's actually much more complex than that. “While we do provide food, water, and shelter for those affected by disasters...we also work on providing medical supplies, rebuilding communities, repairing critical infrastructure like water systems and roads, educating children who have lost schools and classrooms in a disaster…[and] training for future disasters," said Susan McMaster at Direct Relief International.

Generally when you donate to a well known organization that sends money overseas then you are donating to a large centralized fund that will decide what the money should be spent on.

Generally, when you donate to a well-known organization that sends money overseas, then you are donating to a large centralized fund that will decide what the money should be spent on. You can help people who have been affected by a disaster in many ways: by making a financial donation, giving non-financial support or volunteering your time

Donations are tax deductible and may help reduce the tax you pay at the end of the year. When you donate to reputable charities, your donations are used to help people who have been affected by disasters around the world. Donations also help with recovery efforts after the disaster has occurred

What are the major disasters in the last 5 years?

Hurricanes Harvey, Irma, Maria, 2017 California Wildfires, and other 2017 Disasters

Since September 2017, Congress has passed three supplemental disaster appropriations (Public Laws 115-56, 115-72, and 115-123) which together with FEMA DRF and SBA DL funds, are available to help communities recover from Hurricanes Harvey, Irma, Maria, the 2017 California Wildfires, and other 2017 disasters. Below is a time series visualization which shows the total spending for these disasters since March 31, 2018.

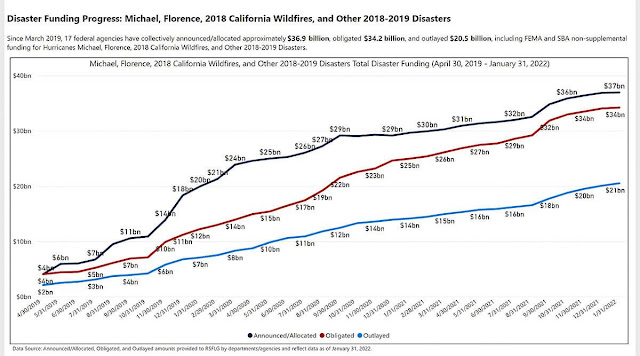

Hurricanes Michael and Florence, 2018 California Wildfires, and other 2018 and 2019 Disasters

Since October 2018, Congress has passed two supplemental disaster appropriations (Public Laws 115-254 and 116-20) which together with FEMA DRF and SBA DL funds, are available to help communities recover from Hurricanes Michael, Florence, the 2018 California Wildfires and other large 2018 and 2019 disasters. Below is a time series visualization which shows total disaster funding for these disasters.